Brent crude may average $57 for a barrel this year, if a six-month extension of Opec production cut is realised, Samba Financial Group has said in a report.

Next year, Brent crude may average higher – $62, a recent Samba report has shown.

“The timing of a market rebalancing will depend heavily on developments in US shale oil, and on whether global decline rates in existing fields are offset by new investment,” Samba noted.

In the short-term, there is a pipeline of existing projects that will go some way to cover depletion rates, but the slump in investment during 2014-16 will start to impact further down the line. In the meantime, prices could be volatile in response to movements in stock levels, Samba said.

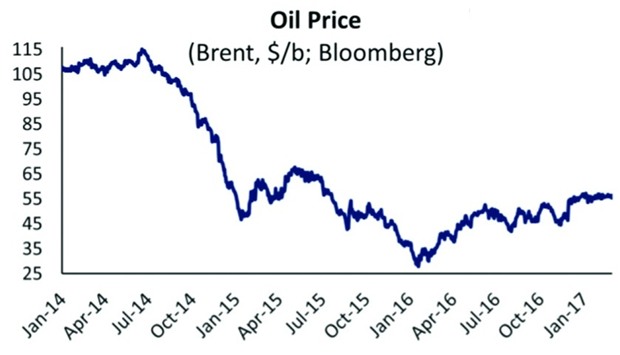

Prices have been trading in a narrow band around $55 for Brent since the start of the year, the report said.

The average for the year to date stands at $56, a healthy increase on the $47 annual average for 2016, but clearly a long way from earlier $100 levels.

While the physical markets, and particularly stock levels, are taking time to adjust, investors appear confident that Opec cuts will bring about a price enhancing rebalancing. Long positioning in oil futures reached record-highs in mid-February, with money managers now reportedly holding around 1bn barrels of financial crude contracts.

This is 10 times the volume of the world's daily physical crude output, and while this investment is currently helping to support oil prices, it also leaves them vulnerable to shifting investor sentiment which could lead to greater volatility and over shoots on the downside, the report said. Meanwhile, oil futures are moving into a “backwardation” pattern when spot and near month contracts are priced higher than contracts in forward months, it noted.

The main reason for the generally constructive view on oil is that Opec is delivering record compliance with its 1.2mn bpd cuts agreed back in November. This set six-month individual production targets starting in January, with a further six month extension possible if stock levels have not drawn as hoped.

Based on available Bloomberg data, Opec's compliance with cuts has effectively been a record 100% in January. The key producer, Saudi Arabia has cut output to just below its target, as have Qatar and Angola, the Samba report said.

Encouragingly, the report said Iranian compliance was also almost 100%. The Ministerial Monitoring Committee has also stated that compliance by non-Opec producers with their own 0.6mb/d in agreed cuts is currently running at 66%.

Given that Russia, which accounts for half the non-Opec cuts, had always said it would phase in its cuts gradually, this is also a “remarkable” achievement, the report said.