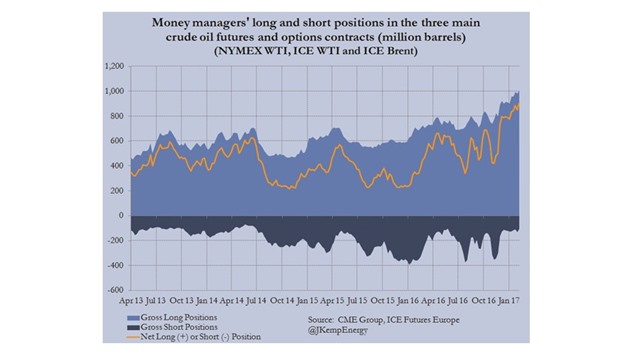

Hedge funds and other money managers have amassed a very large bullish position in crude oil futures and options without so far having much impact on oil prices.

Hedge funds raised their combined net long position in the three main derivative contracts linked to Brent and WTI by another 51mn barrels in the week to February 14.

Funds now hold a net long position equivalent to a record 903mn barrels of oil, according to an analysis of records published by regulators and exchanges.

The combined net long position has a notional valuation of more than $49bn, which is the highest since July 2014.

Hedge funds hold more than 9.5 long positions for every 1 short position in Brent and WTI combined, the highest ratio since May 2014.

Fund managers now have the most bullish view on oil since the first half of 2014, when Libya’s exports were nearly halted by civil war and Islamic State fighters were racing across northern Iraq. The scale of the net long position is puzzling and raises important questions about how it will eventually unwind.

Fund managers have been able to increase their bullish bets with almost no disturbance to the market price of crude.

Volatility has been most remarkable by its absence.

Funds have increased their net long position by 107mn barrels since December 13 while prices have traded sideways in a narrow range of around $55.50 +/- $1.25 per barrel.

Oil prices have been steady at around the $55 level most energy professionals expected would be the average for the year at the start of 2017.

The accumulation of a large long or short position by fund managers has normally been the harbinger of a sharp reversal in oil prices when it unwinds.

So the massive net long position has triggered a heated debate about whether hedge fund managers are fully invested yet or have the potential to increase their exposure even further.

The record net position in barrels and high ratio of long to short positions both indicate the position may already have become stretched.

But that has not stopped hedge fund managers from continuing to raise their combined position in four of the last six weeks.

And while the notional value of the net long position has more than doubled from a recent low of $20bn in the middle of November it remains well below the peak of $69bn reported in July 2014.

The halving of oil prices since the mid-2014 means fund managers can run a net position twice as large in barrel terms for the same commitment of capital.

Some analysts therefore insist funds still have scope to increase their exposure significantly in the weeks and months ahead.

But that raises questions about whether the very large hedge fund position in mid-2014, immediately before the biggest slump in prices for 30 years, is the right baseline for comparison.

There have been suggestions that much of the increase in net long positions comes from pension funds and hedge funds pursuing inflation-linked macro strategies rather than specialist commodity funds and trend followers.

Capital committed by pension funds and macro funds may be more sticky and less prone to abrupt reversals than commitments from commodity specialists and trend chasers.

But there is no way to identify the different types of money managers separately in the published data from regulators and exchanges.

There is no way to prove or disprove the hypothesis that the increase in net long positions is from sticky pension funds and macro tourists rather than flight-prone commodity funds.

Perhaps a more likely explanation is that the production cuts agreed by Opec and non-Opec in November and December 2016, coupled with Saudi Arabia’s resumption of its swing-producer role, have appeared to remove much of the short-term downside risk.

John Kemp is a Reuters market analyst. The views expressed are his own.