Qatar and other Gulf Cooperation Council countries except Bahrain maintain “positive” net asset positions given their large external savings, Samba Financial Group has said and noted that the “GCC debt is rising rapidly, but from very low levels”.

In its latest report, Samba said GCC central banks continue to hold ample reserves, and the region’s current accounts are expected to move back into surplus, except in Bahrain and Oman.

According to Samba, GCC governments have built up large fiscal buffers, which to varying degrees have been drawn on to offset the slump in oil revenues.

They also have low debt levels, and are increasingly issuing domestic and external debt to fund deficits while they look to reform their economies.

As a result, public debt is rising fast, all but Bahrain maintain net creditor positions and are “well short of the 60% of GDP EU debt target”.

The report noted 2016 was notable for the surge in sovereign external debt issuance, both in bonds and syndicated loans. Even Kuwait with over 500% of GDP in external savings is preparing a large bond sale to help cover its gross financing needs.

Excluding mandatory transfers to its Future Generation Fund and investment income, Kuwait’s annual budget deficit was around 17% of GDP in 2015-16.

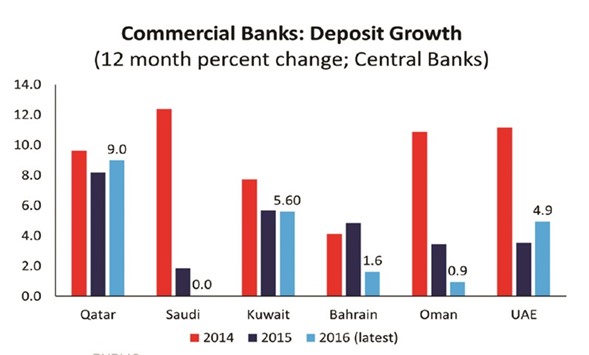

In general, GCC bank deposit growth continued to slow in 2016 in line with declining public revenues/spending/deposits, Samba said.

However, more recent recourse to international financing has helped improve liquidity and should continue to do so this year as public financing needs also decline. Central banks have also directed public institutions to place deposits with banks, while non-resident deposits have surged in Qatar.

Expanding public sector credit and private sector recourse to bank finance to offset payment delays kept 2016 credit growth in double figures in KSA and Kuwait, Samba said.

Elsewhere credit has slowed, although tight liquidity conditions could ease somewhat this year. Under pressure from lower public spending the non-oil private sector appears to be holding up. The monthly KSA PMI surveys continue to point to expansion, although the employment sub-component is struggling to stay positive, it said.

A similar story is apparent in the UAE, and GCC-wide it will be critical that the private sector increasingly becomes the engine of growth and employment creation, Samba said.

To this end, it said the GCC governments have embarked on supportive policies and reforms, and there is scope for substantially improving the environment for business development and growth.

“Labour market reforms, privatisation, and partnerships with the private sector are all in prospect as governments look to alter incentive structures and boost productivity,” Samba report said.

.