Airbus Group booked 320 jetliner orders in December alone to rack up 731 sales for the year, extending its backlog and beating Boeing Co.

In the last month of 2016 Airbus sold 98 new planes to Iran Air and 72 to Go Airlines India, while two other transactions saw 132 narrow-bodies purchased by buyers whose identities weren’t disclosed, according to figures released by the Toulouse, France-based company yesterday.

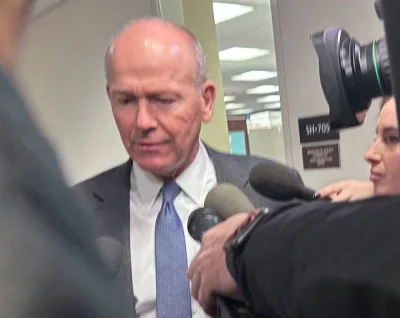

Airbus retained an order lead over Boeing it has held since 2012 after the US business last week said 2016 sales totalled 668 aircraft, net of cancellations. Both manufacturers saw new business dwindle last year as demand ebbed after a decade-long buying spree that’s built up record backlogs. Airbus sales chief John Leahy said he’s not concerned about the slowdown.

“We are essentially sold out at this point,” Leahy said in a televised briefing on the numbers. “That doesn’t mean we can’t increase our production, and we will next year and the year after. We have to build what we already have orders for, not worry about getting new orders.”

Airbus’s sales tally slipped by almost 350 aircraft in 2016 and Boeing suffered a 100-jet decline, though the US company’s figures didn’t include 80 planes it has also agreed to provide to Iran and which would have given it a narrow order victory. Lower oil prices are also leading airlines to carry on operating older, less efficient planes, while stuttering economies have spurred cancellations and crimped net order numbers.

Among Airbus’s unidentified buyers, one is a Middle Eastern customer that’s taking 90 narrow-bodies, the sales chief said. That could refer to Saudi Arabian discount carrier Flynas, which is close to announcing an A320 deal for more than 60 planes, people familiar with the purchase plan said Monday.

An Asian airline is also purchasing 42 planes, Leahy said. The leasing arm of China’s Bank of Communications has agreed to buy that number of jets, Reuters has reported.

Airbus handed over 688 aircraft in the year, beating its target of 670, as it delivered 111 planes in December, a record for the month.

The company shipped 49 A350s, one short of its target, versus just 12 in the first six months, after largely resolving delays at seat and interiors supplier Zodiac Aerospace, Fabrice Bregier, its chief operating officer and civil unit head, said in the briefing.

“We were blocked until summer last year. But things have started to improve,” Bregier said. Issues with A320neo engines supplied by Pratt & Whitney, which led launch customer Qatar Airways to refuse to take the model, have also been addressed and deliveries should triple in 2017 from 2016’s 68, he added.

Demand for the original A320-series plane remains strong, and the model could carry on securing buyers beyond this year, Bregier said.

With Airbus’s order total higher than the delivery figure, it maintained a book-to-bill ratio above one and swelled its backlog to 6,874 planes. While Boeing remains the world’s No 1 plane maker after delivering 748 jets, its backlog declined by 80 aircraft to 5,715.

Leahy said that though deliveries this year will climb above 700, the book-to-bill figure is likely to be less than one, implying that orders may fall again.

Issues with A320neo engines supplied by Pratt & Whitney, which led launch customer Qatar Airways to refuse to take the model, have also been addressed and deliveries should triple in 2017 from 2016’s 68, Fabrice Bregier, Airbus chief operating officer and civil unit head, said.