Oil demand is expected to grow in Qatar and many other neighbouring countries including Kuwait, Saudi Arabia and the UAE this year, driven by the transportation and industrial sectors, a new Opec report has shown.

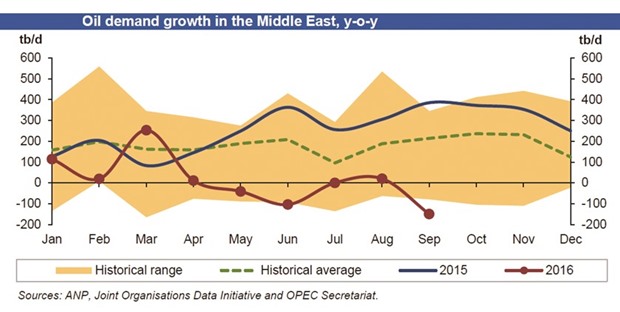

Demand in the Middle East region has been projected to grow by 0.11mn barrels per day (mbpd), Opec said in its latest market report.

However, in 2017, the “Middle East oil demand growth may be challenged by some downside risks, due to geopolitical turbulence in the region,” Opec said.

In the Middle East, “slower-than-expected” oil demand requirements were registered during October 2016 with oil demand in Saudi Arabia declining sharply for the second straight month. Demand has now declined in eight out of 10 months in 2016 in Saudi Arabia, affecting the overall Middle East oil demand picture last year.

This decline, Opec said, was primarily due to the “continuing decline in consumption” of direct crude for burning.

Focusing on product performance, LPG, gasoline and fuel oil all recorded gains of around 17%, 2% and 34% y-o-y, respectively, with fuel oil being supported by power generation consumption, especially in the western part of the country.

Year-to-date, hefty declines in heavy distillates, particularly in the other products category, and direct crude burning have led to a sharp drop in overall consumption of the country of 3.3% year-on-year.

This is contrary to the average oil demand growth seen during the past five years. The completion of the Wasit gas plants in March last year has replaced some of the direct crude burning for power generation and is expected to replace even further quantities in the near future, the Opec report said.

Air traffic activities were also slower than a year ago due to the end of the seasonal travel period, as well as the high base of comparison denting growth levels. In October 2016, the total oil demand in Saudi Arabia reached 2.49 mbpd.

According to Opec, the recent pick-up in global economic activity in combination with supportive developments in the oil-market is seen leading to higher economic growth of 3.1% in 2017, following a 2.9% growth in 2016. However, some downside risks prevail as policy decisions may lead to the use of stimulus measures that may lift inflation to levels higher-than-anticipated by central banks.

“This in turn could lead to a quicker-than-expected rise in interest rates triggering numerous repercussions on economic growth in various economies, mainly in emerging markets,” Opec said.

Despite these uncertainties, Opec noted the economic landscape is expected to improve in 2017. The OECD (Organisation for Economic Co-operation and Development) economies are forecast to grow at 1.7%, the same level as in 2016.

Russia and Brazil are forecast to grow by 0.8% and 0.4% in 2017, respectively, after two years of recession.

China and India are forecast to expand at a slightly slower pace in 2017 – at 6.2% and 7.1%, respectively, compared 6.7% and 7.5% in 2016 – growth remains encouraging, the report showed.