Oil

Oil prices rose more than 1% on Friday and posted sharp weekly gains after Opec and its allies agreed to deepen output cuts by 500,000 barrels per day in early 2020. The additional cuts by Opec and other major producers including Russia will last throughout the first quarter. The group will meet again in early March for an extraordinary meeting to set its policy.

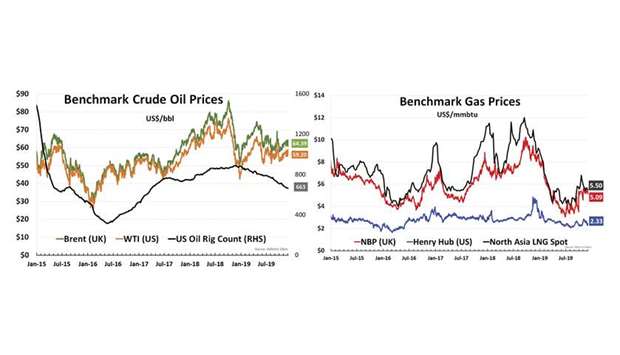

Brent futures settled 1.6% higher at $64.38 per barrel and rose about 3% on the week. West Texas Intermediate oil futures rose 1.3% to $59.20 a barrel and about 7% on the week. This was WTI’s biggest rise since June, after the US government data on Wednesday showed domestic crude stockpiles falling for the first time in six weeks.

The Opec+ cuts next year are in addition to the group’s previous agreed curbs of 1.2mn bpd and will represent about 1.7% of global oil output. Opec will shoulder around two thirds of the additional cuts. Saudi energy minister said the Kingdom would continue a voluntary cut of 400,000 bpd. He added that after improved compliance from other members, the actual cut will be effectively 2.1 mbpd.

Any price gains from the Opec+ cut are likely to benefit American producers not party to any supply curbing agreement. US drillers have been breaking production records even as they have cut the number of oil rigs in operation for 12 straight months, boosting the US to the top world producer spot.

Gas

Asian spot prices for LNG dropped for a second consecutive week as supply flooded the market, overshadowing demand subdued by a winter that has been milder than average. The average LNG price for January delivery into northeast Asia is estimated to be about $5.50 per mmBtu, down 10 cents from the previous week.

In supply, Angola LNG offered a cargo for delivery over late January to mid-February in a tender that closes next week while India’s GAIL offered up to 10 cargoes on a free-on-board (FOB) basis from the Sabine Pass and Cove Point LNG plants in the US for loading from early next year to early 2021.

The lower spot prices appeared to stoke some demand from China, Japan and India. China’s Guangzhou Gas and Japan’s Tohoku Electric Power each sought a cargo for delivery in late January, while in India, GSPC and Reliance Industries are both seeking cargos for delivery in January. However, temperatures in the Far East are expected to be mostly warmer than average over the next two weeks, which is expected to keep demand low. South Korea’s LNG demand is also set to slow over the next two years, despite a number of coal plant closures. The drop in coal power production will be offset by weaker electricity demand and new nuclear output.

In Europe, NBP fell by nearly 4.5% from the previous week, settling at $5.09 MMBtu, mainly driven by a surge in LNG send-out.

In the US, Henry Hub spot prices rose by 2% from the previous week to settle at $2.33 MMBtu.

n This article was supplied by the Abdullah bin Hamad Al-Attiyah International Foundation for Energy and Sustainable Development.

.