For all the obvious negatives – think surging oil prices, trade tensions and the US Federal Reserve having possibly reached the limits of its dovishness – emerging markets are keeping their heads above water.

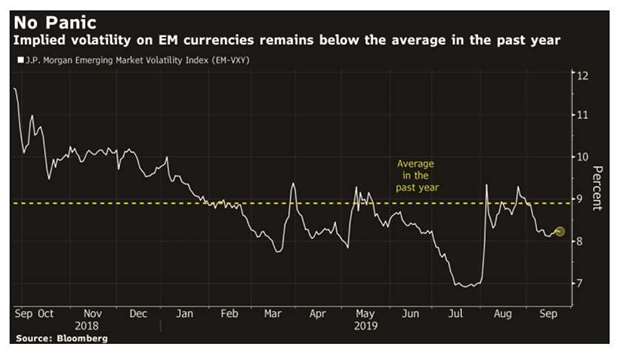

While developing-nation currencies just weakened for the first time in three weeks, their implied volatility, at around 8.25%, remains below the past year’s average. The yield on emerging-market local-currency debt is within 10 basis points of the all-time low of 4.12% reached in August. And the MSCI Index of stocks isn’t far off its highest level in seven weeks.

“We maintain an optimistic outlook for emerging markets going into the next few months as global central bank accommodation overshadows concerns of slower global economic growth,” said Anders Faergemann, a senior portfolio manager at Pinebridge Investments in London.

“The overall market has taken the oil shock, the Fed meeting and the repo market confusion in its stride, suggesting it would have to take an even bigger flare up in risk to unsettle financial markets.”

Some $933mn flowed into emerging-market debt-dedicated funds in the week through September 18, compared with $443mn the previous week, according to Morgan Stanley. Central banks in Egypt, the Philippines and Mexico will probably cut interest rates this week as policy makers around the world look to boost their economies.

US-China trade tensions appear to be on the mend for now after China’s Ministry of Commerce signalled that both sides held “constructive” talks in Washington last week, though not everyone is buying into that narrative.

Sentiment was also buoyed after Chinese officials emphasised that the cancellation of a planned visit to farms in the US had nothing to do with trade talks.

Oil prices may continue to be volatile too, after the US sent more troops and weapons to Saudi Arabia and Iranian Foreign Minister Mohammad Javad Zarif refused to rule out a military conflict. Oil importers with current-account and fiscal deficits – including India and South Africa – remain vulnerable to a further jump in energy prices.

More easing

Just days before Egypt’s central bank is expected to slash its benchmark rate, concern that rare protests against President Abdel-Fattah El-Sisi’s government may escalate sent the nation’s dollar bonds sliding.

l Egypt has attracted bond investors with some of the highest real interest rates in the world; inflation slowed to 7.5% in August, the lowest level since early 2013.

The central bank has already cut rates twice this year, reducing its benchmark by a total of 250 basis points.

l “Should political uncertainties rise, the negative impact on Egyptian risk assets could be more sustained,” Farouk Soussa, an economist at Goldman Sachs in London, says in a note. “In such an environment, we believe the CBE may see cause to hold rates on Thursday.”

l Economists surveyed by Bloomberg expect the central bank of Philippines to cut rates by 25 basis points Thursday. This is based partly on comments last week from Governor Benjamin Diokno. The rise in oil prices following the attack on Saudi Arabia’s oil facilities is “not yet a worry” he said, despite the Philippines being a net oil importer.

l Mexican TIIE swap rates are pricing in 60 basis points of rate cuts for the rest of 2019 as the central bank prepares for its next meeting on Thursday. Economists expect authorities to lower borrowing costs by 25 basis points as inflation slows and the economy stalls.

l The Bank of Thailand is expected to maintain its policy rate on Wednesday, according to a majority of economists surveyed by Bloomberg, following a surprise 25-basis-point cut at its August meeting.

l Hungary’s central bank will set its monetary-policy stance for the next three months today, with most analysts expecting no change to the unconventional toolkit. The ECB’s easing measures will weigh against still-high core price pressures in Hungary and the forint trading at a record low.

l Czech policymakers will probably leave policy unchanged for a third consecutive meeting, even as a debate about the need for further tightening continues among officials Colombia and Kenya will probably keep their benchmark rates unchanged; Morocco will also decide on policy today.

l Brazil’s central bank may provide more hints about the extent of its easing cycle when minutes of its latest meeting are released today. Traders have priced in more aggressive rates cuts, dragging down the real, after policy makers announced their latest reduction last week. Investors are debating how much more the currency can weaken before the central bank turns more hawkish.

Index decisions

FTSE Russell will announce the results of an annual review of its World Government Bond Index, with investors likely to focus on the possible inclusion of China and Israel, as well as on the potential exclusion of Malaysia.

l An exclusion announcement could possibly trigger outflows of $5bn to $6bn from the ringgit bond market, according to analysts at Goldman Sachs Group.

Economic pulse

Malaysia inflation data is due tomorrow, with price levels having picked-up considerably since January.