The US blacklisting of Huawei Technologies Co and other top Chinese tech companies is making it trickier for some mobile industry professionals to get down to business.

The June 26-28 Mobile World Congress Shanghai, China’s largest forum for the mobile industry, is scheduled to start amid almost daily salvos from the Trump administration aimed at Huawei and other technology companies in the world’s largest mobile phone market.

The Trump administration’s blacklisting of Huawei has dominated global industry discussions in past months, as it threatens to upend supply chains and disrupt the global roll out of fifth-generation technology – an infrastructure spending spree worth hundreds of billions of dollars. US-Chinese tensions are escalating just as carriers around the world such as China Mobile Ltd and China Telecom Corp – set as keynote speakers at MWC Shanghai – choose equipment vendors for the 5G networks expected to support technologies from remote surgery to automated factories and driverless cars.

“It’s quite a sensitive moment,’’ said William Chou, managing partner of Deloitte Private in Beijing, and a scheduled speaker at the conference’s key Global Device Summit session. He said it’s unlikely Huawei and ZTE will want to show off all their latest devices at MWC Shanghai given how the perception that they are ahead of global rivals has fuelled tension.

The focus will instead be on 5G applications and how the vastness of China’s market is likely to drive development, Chou said.

“We really need to understand the market, putting aside the political agenda,” said Chou. “Business is still business, and particularly in this telco area – telcos and device manufacturers – they all need to work together.”

China’s vulnerabilities exposed: Where tech war will hit hardest

The Shanghai event is modelled after a bigger annual industry show in Barcelona. This year’s gathering in Spain was also squarely focused on Huawei and China, a nod to the country’s rising global importance and to how the Washington-Beijing dispute is creasing the business environment.

“The danger for international companies, especially American companies, is that they are ceding these opportunities to influence the marketplace to non-American companies, which can have knock-on consequences that could be far greater than some had anticipated,’’ said Jake Saunders, a vice president at ABI Research, and a scheduled speaker and moderator at the conference.

A two-hour flight away in Osaka, Huawei is also likely to be on the agenda for a meeting between the presidents of China and the US at the G-20 summit.

Last week, President Donald Trump said he had a “very good telephone conversation” with President Xi Jinping and said talks will resume before the two meet at the June 28-29 summit. It’s not clear if Huawei was part of their call, but it’s an issue Trump himself has said could be on the table.

Trump pressured by Congress to stay tough on Huawei in Xi summit

Trump last year reversed a similar ban on Huawei rival ZTE at Xi’s request. Getting that kind of result now would be significant for Xi because the company is exponentially more important than ZTE, said Samm Sacks, cybersecurity policy and China digital economy fellow at New America.

People familiar with the matter yesterday said China is considering adding US-based delivery firm FedEx Corp to its list of so-called unreliable entities. FedEx drew the ire of Chinese officials after Huawei said that documents it asked to be shipped from Japan to China were instead diverted to the US without authorisation.

What Bloomberg Intelligence says: “China’s early, widespread 5G deployment would entitle it to the spoils of first-mover advantage, including an edge in setting global standards. An aggressive infrastructure and network build-out will be required for a swift rollout, fuelling demand for telecom site resources and equipment.”

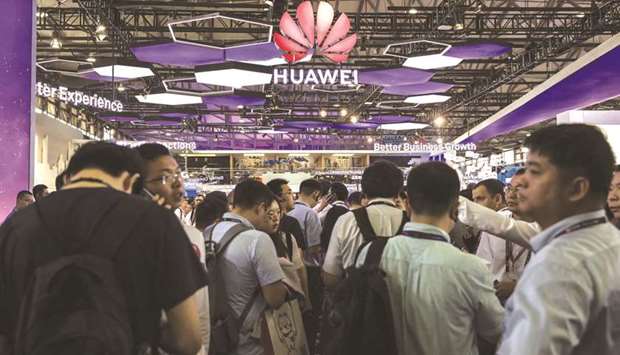

Attendees stand at the Huawei Technologies booth at the Mobile World Congress Shanghai in China (file).