Islamic reinsurance, or retakaful, is faced with a challenging environment in a highly competitive reinsurance market, a new report issued by US-based business intelligence and insurance rating firm A.M. Best notes. This contradicts the perceived attraction of the sector for many investors who view it as a growth opportunity.

The analysts took a close look at the global retakaful market – which is in fact very much concentrated on Southeast Asia and the Middle East – and found that since retakaful become more established in the early 2000s, new companies entered the market, but their success has been limited for a couple of reasons. A number of players have recently run into difficulty or have even exited the market.

“Traditional retakaful operators have struggled to gain traction in a highly competitive reinsurance market because of the limited access to quality business, predominantly resulting from the underperformance of the primary takaful sector,” Mahesh Mistry, senior director of analytics at A.M. Best, says.

“The operating environment is challenging as these companies compete against more established conventional reinsurers in a soft market environment. The sustainability of the retakaful model is likely to be tested over the coming years and it remains debatable whether it can be seen as a viable alternative to conventional reinsurance over the longer term,” he adds.

Even though retakaful operators are generally well-capitalised, poor performance has resulted in capital erosion for the sector over time and thus triggered lower credit ratings compared to it conventional peers, while the operators are having tough times to reach the necessary scale. This is primarily owing to the poor quality of business underwritten, which, in turn, has led to underperformance of their portfolios, the report states.

Current leading players in the retakaful market are Malaysia’s ACR Retakaful Berhad and Malaysian Reinsurance Berhad, Emirates Retakaful Limited, Saudi Reinsurance Company, Dubai’s Takaful Re Limited and Tunisia’s BEST Re Limited, as well as Islamic windows of conventional global insurers such as Swiss Re Retakaful, Munich Re Retakaful, Hannover Re Retakaful, AIG Retakaful and a few other multinational. However, it is estimated that the entire business volume for these operators globally does not exceed $1bn in gross written premiums, while the global reinsurance market was valued at close to $600bn as per the end of last year.

Southeast Asia – mainly Malaysia and to some extend Indonesia and Brunei –, as well as the six Gulf Co-operation Council nations generate the lion’s share of premiums, whereby among the latter region Saudi Arabia through its co-operative model is the primary contributor. As of late, operators in African countries have entered the market, which are doing surprisingly well “by swimming against the tide and successfully managing their retakaful operations,” Aneela Mather-Khan, financial analyst at A.M. Best, states, but they remain still small in size and scope.

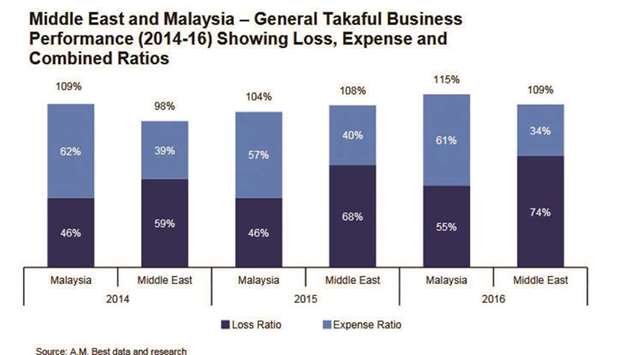

Compared to the conventional sector, the retakaful market general suffers from weaker technical and operating performance with high expense ratios which is unhealthy for their balance sheets in the long run. The most successful companies are those able to underwrite a balanced portfolio of conventional and takaful business, whilst those that have sought to only provide cover to takaful operators have generally suffered, which makes a case for retakaful windows of conventional insurance providers.

The most important requirement for retakaful operators to gain a firm stand in the sector is the ability to attract good quality business, the study concludes. This is also related to how retakaful companies successfully and convincingly differentiate themselves from conventional peers on the market.

“Retakaful operators therefore remain in direct competition with local and international reinsurers. Moreover, the ability of retakaful operators to attract quality risks is further limited by their narrow scope, providing Shariah-compliant solutions predominantly in the Middle East, Asia and Africa,” Mistry says.

The analysts further note that retakaful currently has the best future in branches and subsidiaries of conventional reinsurers providing them an additional revenue stream.

“Retakaful operators that are subsidiaries or branches of larger international reinsurers are operating relatively successfully. The main factors behind this include their ability to take advantage of the economies of scale of the wider group, and to leverage the rating of the group. This can give them access to higher quality business, and enable them to grow their margins and achieve sufficient economies of scale,” Mistry notes.

The standalone retakaful model may be under threat over the long term, unless it is repositioned to add additional value to the reinsurance market, which would have to be supported and enforced by specific regulation in target markets and the respective push of Shariah boards.

fin