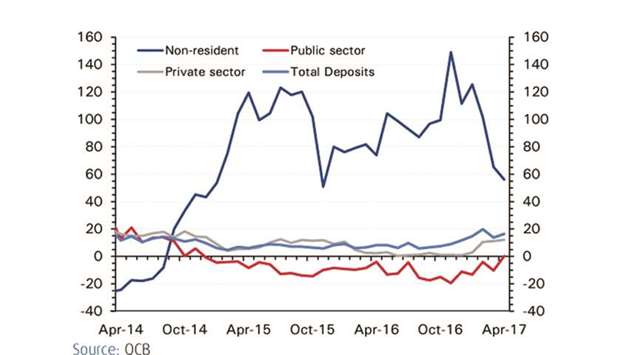

Total deposits rose by 16.4% year-on-year (y-o-y) by end-April. Both public and private sector deposits have led the way, rising by 0.3% y-o-y and 12.1% y-o-y, respectively.

Non-resident deposits, though still increasing at the rate of 56% y-o-y, are not doubling as they were last year, National Bank of Kuwait said in its economic update released yesterday.

The improvement in liquidity is reflected in Qatar’s banking sector’s loan-to-deposit ratio (LDR), which has fallen since the start of the year as deposit growth has outpaced credit growth. As of April, it stood at 111.6%, having been as high as 119.9% in February 2016.

The decline in government deposits (-11.1%) last year and anaemic private deposit growth (0.9%) hastened commercial banks reliance on foreign funds and led to an increase in overseas liabilities.

Net foreign liabilities reached QR182.5bn in April, up 28% y-o-y. Almost all of the liabilities are non-resident deposits, interbank funds and debt securities. They are also largely short-term in nature — less than 12 months.

“Most of the funds raised from overseas have been directed towards local lending, a significant portion of which is financing for the government’s infrastructure projects, which tend to be long term.

“This large foreign currency mismatch plus the extent of the banking system’s reliance on foreign funds — 38% of total bank liabilities and 167% of foreign assets as of April — are part of the reason that Qatar found its long term sovereign rating lowered. S&P cut it by one notch to AA- recently, following the country’s diplomatic isolation by Saudi Arabia and its other neighbours,” NBK Economic Research said.

Increased government borrowing has been driving credit growth in Qatar; the report said, but noted that lending to the private sector remained soft.

In 2016, total credit growth rebounded from the single digit lows of early 2015 to come in at a robust 12.1%, driven by public sector lending. By the end of April, credit growth was ranging around 9% y-o-y, with public and private sector lending growth at 15.9% y-o-y and 5.1% y-o-y, respectively.

“Private credit growth is below where it needs to be to get the private sector fully engaged in the country’s development plan. Real estate lending is especially lacklustre, while demand from industry, contractors and retail consumers remains soft,” NBK Economic Research said.

Although NBK Economic Research expects Qatar’s fiscal restraint to continue this year, it says the deficit should narrow on higher oil and gas revenues.

Qatar recorded its second consecutive fiscal deficit in 2016, at -9% of GDP. Lower oil and gas revenues as a result of the oil price downturn have significantly affected the government’s finances.

Fuel and utility subsidies were cut, and non-essential infrastructure scaled back, as in other GCC states. This year should see further fiscal restraint, but with spending targeted to a greater extent at infrastructure projects, many of which need to be completed in time for the FIFA World Cup in 2022. The deficit is expected to narrow to -5.1% of GDP in 2017 and to -3.5% of GDP in 2018, thanks largely to an expected improvement in energy prices, NBK Economic Research said.