Saudi Energy Minister Khalid al-Falih said after a meeting of the Organisation of the Petroleum Exporting Countries (Opec) and its allies on Monday that his country would limit crude oil exports to 6.6mn barrels per day (bpd) in August, almost 1mn bpd below levels a year ago.

This commitment is belated recognition that Opec and its non-Opec allies, including Russia, have to do more than just comply with their November agreement to cut output by a combined 1.8mn bpd.

For the output restrictions to work by draining global oil inventories, the producers will also have to curb exports.

Vessel-tracking data from Thomson Reuters and other service providers suggest that cuts to exports in the first half of 2017 by Opec and its non-Opec allies haven’t matched the reductions in stated output.

However, data from Asia’s top two oil importers, China and India, show that Saudi Arabia is already taking much of the pain by cutting the amount of crude it supplies. China imported the equivalent of 8.56mn bpd of crude in the first half of 2017, up 13.8% on the same period a year earlier, according to calculations based on customs data released on Monday.

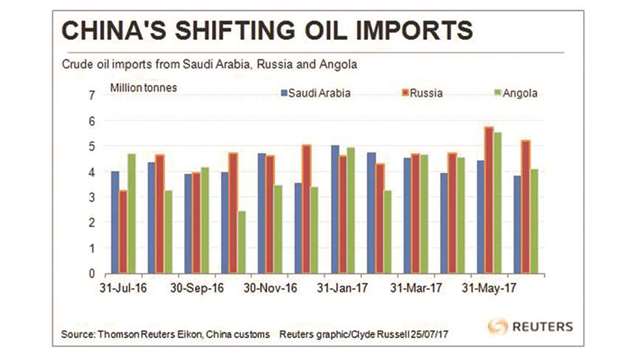

Of this Saudi Arabia supplied 1.07mn bpd, a gain of just 0.5% over the first half of 2016.

This meant that Saudi Arabia, which was China’s top supplier in 2015 and was only just pipped by Russia last year, has now slipped to third.

Russia supplied 1.18mn bpd in the first half, an increase of 11.3% from a year ago that saw it maintain its top position, while Angola leapfrogged into the second spot with 1.09mn bpd, a jump of 22% from the first half of 2016.

Both Russia and Angola are party to the agreement to restrict output, as is Iraq, which boosted its supplies to China by 5.6% in the first half to about 720,000 bpd, becoming the fourth-largest source of oil imports. Also worrying from the Saudi perspective is that producers outside the output agreement showed sharp increases in Chinese imports, with Brazil supplying 501,000 bpd, a leap of 48% over the first half of last year.

Because of the restrictions on Opec and non-Opec supply, China has turned to oil from non-traditional suppliers, with imports from Britain amounting to about 190,000 bpd, up 186%, and from the United States about 123,500 bpd, up a staggering 1,348%.

In India, a similar dynamic is at play, with imports from Saudi Arabia dropping 8.4% in the first half of 2017 to 759,100 bpd, placing the kingdom behind new top supplier Iraq with 847,200 bpd, a gain of 0.3%.

India boosted imports from Iran by 57.8% to 539,500 bpd, while those from Angola rose 9.5% to 128,600 bpd, according to tanker data compiled by Thomson Reuters. While not a major supplier to India, Brazil supplied 107,300 bpd in the first half, a gain of 82.5%.

Also, imports from Mexico, another producer outside the output deal, jumped 62.4% to 133,700 bpd.

Putting the Chinese and Indian import data together and the picture that emerges is that Saudi Arabia is giving up market share, while some of its allies aren’t.

The question then becomes whether the kingdom views this as sustainable, and how long will it be prepared to cut its exports to major buyers while others seemingly don’t.