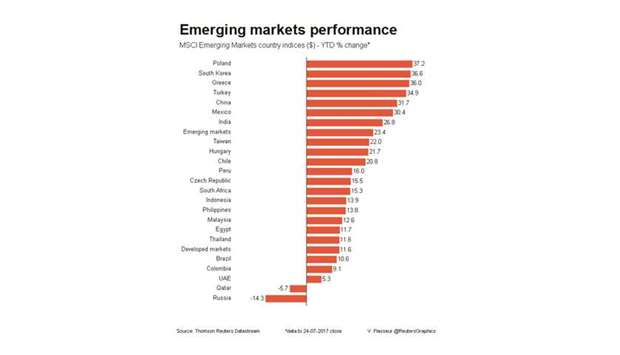

MSCI’s emerging market benchmark weakened 0.2%, pulling back from the 27-month high hit on Monday as losses across Asia weighed on the index, which has rallied ten out of eleven previous session.

Stocks in South Africa gained 0.7% while Turkish peers rose 0.4%. But the gains failed to make up for heavyweight South Korea, which closed 0.5% lower as offshore investors took profit.

China’s bluechip index slipped 0.6% with fresh talk by Beijing about preventing systemic financial risk reigniting fears of tighter regulations. And while India’s main index topped 10,000 points for the first time on hopes for better earnings, accelerating economic growth and government reforms, it later eased 0.1%. Currencies fared little better with South Africa’s rand and Turkey’s lira weakening 0.2% despite a lacklustre dollar.

The dollar failed to hold onto gains made earlier in the session on better-than-expected economic data and expectations that the US Federal Reserve will signal at a meeting its readiness to begin reducing its bond portfolio at its September meeting.

Fresh signs that the administration of US President Donald Trump was struggling to make significant progress on fiscal reforms should keep the dollar tame and a Fed interest rate hike off the cards for this year, said Piotr Matys, emerging markets strategist at Rabobank.

“We have witnessed quite impressive gains across emerging markets so it is just pausing, but the outlook is still relatively positive,” said Matys.

“It is not only about this very gradual pace of monetary policy tightening by the Fed, but various emerging markets are growing...and there is scope for emerging markets to expand in the second half of this year.”

Meanwhile higher oil helped Russia’s rouble strengthen 0.3% following two days of losses.

Crude prices extended gains after Saudi Arabia pledged to curb exports from next month and Opec called on several members to boost compliance with output cuts to help rein in oversupply and tackle flagging prices.

Across central Europe, Poland’s currency was the best performer.

The zloty advanced 0.3% against the euro as President Andrzej Duda yesterday signed into law a bill giving the justice minister the power to hire and fire the heads of ordinary courts.

The bill was one of three passed by parliament as part of the Law and Justice (PiS) party’s flagship judicial reform plan, which brought tens of thousands of protesters onto the streets and raised concerns in the European Union and Washington.

In a surprise move, Duda had vetoed two of three judicial reform bills passed by parliament.

In Nigeria, central bank policy makers are expected to keep interest rates at 14% when they publish their decision later. Africa’s largest economy, in its second year of recession, had been battling stubbornly high inflation which stood at more than 16% in June.