Oil market is expected to “rebalance” in 2017; QNB said and noted that it is keeping its oil price forecast unchanged at $55/b.

Oil prices in 2017 have been determined by two main counterbalancing forces — supply cuts led by Opec and rising shale oil production in the US, QNB has said in an economic commentary.

The production cuts agreed in November 2016 between Opec and some other major non-Opec producers drove a rally in prices towards the end of 2016 and into 2017.

The implementation of those cuts at the beginning of 2017 helped keep prices high during January and February.

However, in March and April oil prices weakened amid doubts about compliance with the agreement and concerns about rising US production. “We examine four key questions around Opec and non-Opec supply that will be critical for global oil markets this year and find that US production increases are likely to cap oil prices at around $55 while Opec production cuts will provide a floor,” QNB said.

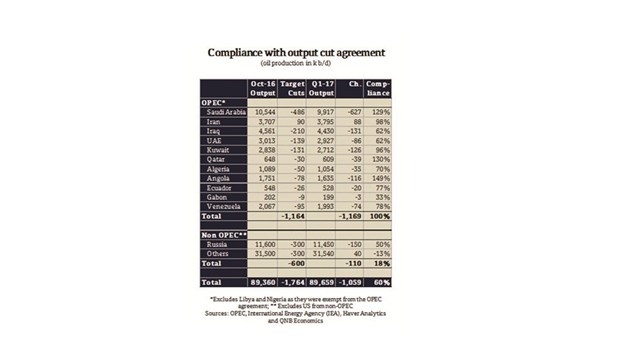

First, is Opec complying with output cut targets? Overall, Opec’s compliance with the targets for output cuts set in November was 100% in Q1, 2017. Much of this is attributable to Saudi Arabia cutting production by more than agreed, but there was a high compliance rate among other Opec members as well.

Second, are other major producers complying with their targets? Non-Opec producers who were party to Opec’s November agreement have been less compliant. Russia has achieved around half of its targeted cuts, but others have actually increased production slightly.

As a result, overall compliance among Opec and non-Opec members was around 60% during Q1 2017, QNB said. The slippage from targeted cuts may have contributed to the recent weakness in oil prices.

Third, is US production increasing in response to higher oil prices? “It appears so,” QNB noted.

US production has risen steadily since the latter part of 2016 as oil prices consolidated between $55-60, the estimated range of US shale breakeven costs. US crude oil production averaged around 8.5mn bpd in September compared with 9.2mn bpd so far in April, predominantly as a result of higher production from shale oil fields where output can respond rapidly to higher prices.

Fourth, will Opec extend its agreement to cut output beyond June when it meets on 25th May? An extension to the Opec agreement is becoming increasingly likely. Discussions between producers have moved in favour of extending.

The Saudi oil minister recently said that Opec and non-Opec producers were close to reaching a deal to extend the cuts. Additionally, an extension to the agreement would sustain prices at the current level or higher.

However, there are also arguments against extending. The lack of compliance with last year’s deal among non-Opec producers might make it difficult to broker a new deal.

Furthermore, QNB said the production cuts have handed a lifeline to US producers, which have managed to increase production in response, grabbing market share.

The bottomline is that the output cuts are likely to be extended, but even if they are not, aggregate world oil supply will probably remain largely unaffected.

Any increase in Opec production after June would probably push down prices and deter further increases in US production, it said.

OIL