The world’s third-largest economy, Japan, continues foraying into the global Islamic finance sector in order to benefit from previously untapped opportunities in this rapidly growing industry. Earlier this month, Mizuho Bank, one of the largest financial services companies in Japan, through its Malaysian subsidiary became the next Japanese commercial bank to enter an Islamic finance deal with a foreign banking institution by signing a murabaha credit facility agreement valued at $300mn with the Islamic Corp for the Development of the Private Sector (ICD), a unit of Saudi Arabia-based Islamic Development Bank. The two-year financing term will be used to fund projects undertaken by ICD in its member countries and is the first cross-border bilateral Islamic facility for Mizuho Bank.

“Lending to ICD will expose Mizuho Bank Malaysia indirectly to the markets in Islamic countries,” said Shinichi Nishiyama, Mizuho Bank Malaysia’s deputy CEO, adding that the bank was looking forward to a “long-term partnership with the ICD to strengthen its capacity to develop its Shariah-compliant business.”

The agreement follows a similar deal between the ICD and Bank of Tokyo-Mitsubishi UFJ on a $100mn murabaha facility back in 2014. The development financing deals are seen as Japan’s first responses to the newly established, China-backed Asian Infrastructure Investment Bank (AIIB) in its the goal to counter the AIIB’s growing influence by investing more in tangible infrastructure assets in Asia.

But not only infrastructure investments are on the roadmap of Japan’s Islamic finance strategy. The country is actively debating the potential utilisation of Islamic finance on its domestic market and also the possibility to attract petrodollar investments from Gulf states.

As of late, Japan has also been embracing local Muslim culture and its banking sector seeks ways to meet the needs of this growing niche.

Bank of Tokyo-Mitsubishi UFJ has so far been the most active Japanese bank in Islamic finance and also issued a $25mn sukuk in Malaysia through its Kuala Lumpur branch in 2014 and in July 2015 obtained a license from the Dubai Financial Services Agency to operate an Islamic window in the emirate.

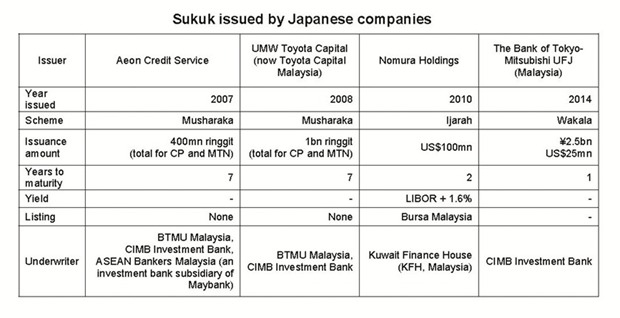

Prior to that, institutions such as Nomura Holdings, Aeon Credit Service and Toyota Financial Services Corp issued corporate sukuk through their Malaysian subsidiaries, and insurer Tokio Marine, the longest-established insurance company in Japan, launched takaful businesses targeting local customers in Saudi Arabia, Indonesia, Singapore and Malaysia.

Another involvement of Japan in the Islamic finance sector is a cooperation between Tokyo-based financial services company Strategic Business Innovator (SBI) Holdings and the Ministry of Finance of Brunei which launched a joint venture called SBI Islamic Fund (Brunei) Limited that focuses on Islamic investment opportunities in Indonesia and has already issued two Shariah-compliant financing facilities to private investors used to fund a logistics business and fish processing factories in the country.

Japan’s capital market regulator Financial Services Agency supports Japanese banks to conduct Islamic finance business on foreign markets by allowing their foreign subsidiaries to take Islamic deposits. Currently, the sector is waiting for amended banking regulations that would enable banks to provide Islamic finance and banking products on the domestic market for the first time. The move to allow sukuk and similar products to be bought and sold in Japan, Asia’s largest bond market, would certainly give the entire Islamic finance sector a boost.

However, possible regulation changes are still in the consultation stage, mainly to sort out taxation issues and a legal framework to clarify in how far a bank should be allowed to buy goods on behalf of its customers under the murabaha concept. At least the terms have been coined: Japanese sukuk are now known as J-sukuk (sukuk potentially issued by Japanese banks or financial institutions to Islamic investors) and Samurai sukuk (issued by foreign banks or companies in Japan).

Private sukuk issuances by Japanese financial companies up to 2014. Bank of Tokyo-Mitsubishi UFJ and Mizuho Bank joined with multimillion murabaha facilities in cooperation with the Islamic Development Bank in 2014 and 2017, respectively. Source: Nomura Institute of Capital Research.