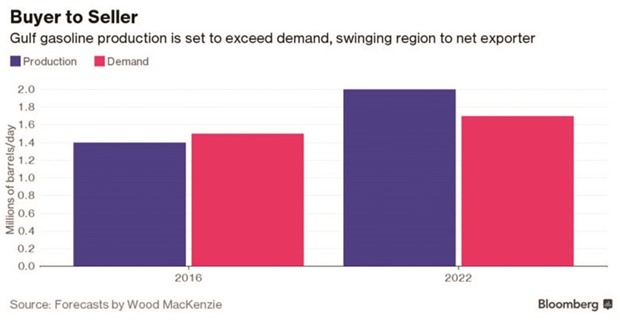

Expanding fuel shipments from the Arabian Gulf will intensify competition from Europe to Asia, squeezing profits across the global refining industry and contributing to a looming glut of oil products.

As Saudi Arabia, Iran and other crude suppliers build new oil-processing plants and upgrade old ones, the Gulf region is poised to become a net exporter of refined products as soon as this year. This heralds a tougher contest for sales between state companies in the Gulf, the trading houses that currently supply them and Asian refiners that are also boosting exports.

European refiners are set to lose out as newer rivals from the Middle East, India and China vie with them for sales, according to consultants Wood Mackenzie Ltd and FGE. Saudi Arabia and Abu Dhabi have built export-oriented refineries with a combined capacity of almost 1.4mn bpd over the last four years, and the Gulf region is already selling diesel in Europe.

“The region is getting near to balanced and is bringing on more capacity,” Gati al-Jebouri, the head of Lukoil’s Middle East business, said in an interview in Dubai. “As more fuel is exported, with Europe not growing, it’s logical that producers will start looking to new markets in East Africa or Asia.”

While the Middle East’s ability to pump oil has historically run far ahead of its ability to refine it, the region has expanded processing capacity by about 20% since 2013 and state oil companies are enlarging or upgrading plants to produce cleaner-burning fuels to help diversify local economies. This expansion, funded by windfall profits when crude averaged close to $100 a barrel, may exacerbate an oversupply of refined products.

Saudi Arabia plans to double refining capacity to as much as 10mn bpd within 10 years, Saudi Energy Minister Khalid al-Falih has said. Saudi Arabian Oil Co, the state producer known as Saudi Aramco, expects to start operating a 400,000 bpd refinery next year at Jazan on the Red Sea, adding to two other plants of the same size that have come online since 2013.

Neighbouring Abu Dhabi, which holds most of the oil in the UAE, more than doubled capacity at its Ruwais refinery to 817,000 bpd in 2015. Iran expects to start producing gasoline this year at the Gulf Star refinery and to export the fuel as early as 2018. Kuwait plans a 615,000-bpd refinery by 2020, and Oman is expanding its largest facility this year.

The region’s production of refined fuels is catching up with local demand, said Richard Mallinson, an analyst with consultant Energy Aspects Ltd in London. “Patterns are definitely shifting, as traditional import markets are seeing their volumes changing or are disappearing entirely,” he said.

Gasoline imports by Gulf states will fall to about 150,000 bpd this year from about 200,000 bpd in 2016, and the region will produce more gasoline than it consumes by 2019, said Iman Nasseri of FGE. “With a global oversupply of products, you’ll see some plant closures and some running below capacity,” he said by phone from London.

Competition from the Gulf expansion is a threat, according to Francis Duseux, chairman of the French oil-industry association Union Francaise des Industries Petrolieres. “We must remain vigilant,” Duseux said at a March 7 news conference in Paris. “We must continue to invest and trim costs.”

As European refineries come under more pressure, export-focused processors in the Middle East and Asia will look to Indonesia, Vietnam and fast-growing nations in East Africa to soak up excess supply, according to FGE. Refiners worldwide will add 8.1mn bpd of capacity by 2021, according to Bloomberg Intelligence.

Refiners in China and the Middle East will add more than half of the forecast 7mn bpd of new capacity by 2022, the International Energy Agency said in its 2017 Oil Market report released this month.

Even with the Gulf exporting more products, traders can still play a role in meeting supply gaps in the region, said Paul Himsworth, head of Vitol Group BV’s Dubai office. “A growth in refining capacity in the region will not only produce more gasoline but a surplus of other products that will need to be efficiently placed in the wider international market,” he said on March 7.

The Gulf’s role as a supplier of gasoline and diesel could be cut short if local demand for products keeps rising. Gasoline use in the region is seen increasing by 3% to 5% annually through 2020, according to FGE and Tushar Tarun Bansal, head of consultant Ivy Global Energy in Singapore.

“We see capacity additions running ahead of demand out through at least 2020,” creating an oversupply of products, John Stewart, an analyst at Wood MacKenzie, said in a phone interview from Dubai. “The new Middle East refineries will keep on running near capacity, as they’ll be very competitive on global markets.”

.