Brent futures prices for the second quarter have risen strongly in recent days suggesting traders expect the oil market to move into deficit earlier or that a squeeze is underway.

Calendar spreads for nearby months have tightened sharply since the middle of February to a level that will make storing oil outside the United States unprofitable from the start of the second quarter onwards.

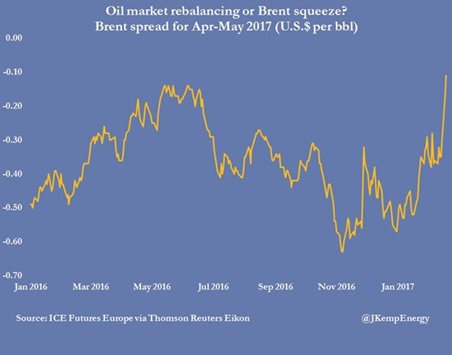

The calendar spread from April to May has tightened from a contango of 35 cents per barrel on February 15 to just 17 cents on February 20 and is now trading around 12 cents. The spread is now too narrow to cover the cost of financing and storing barrels under any set of realistic assumptions about the cost of borrowing money and leasing tank space.

Spreads are even narrower for later months, with a contango of just 10 cents for May-June and 7 cents for June-July.

The spread tightening has been concentrated in the second quarter which implies traders now expect a supply deficit to occur from April rather than June. Calendar spreads have tightened much more in Brent than in WTI — where the spreads remain wide enough to finance crude stockpiles in the United States through until about June. If the tightness in Brent persists, physical traders will have an incentive to unwind cash-and-carry storage trades where they hold a long position in physical oil and a short position in futures.

Physical barrels will be sold from stockpiles to refiners and reported inventories should start to decline rapidly.

Senior Opec officials have repeatedly cited a shift in oil market structure from contango to backwardation as one of their intermediate objectives for oil market rebalancing.

Hedge funds have accumulated a record bullish position in crude futures and options in the expectation that Opec will succeed. Fund managers have also amassed a large bullish position in options on the calendar spreads in a direct bet the market will move from contango towards backwardation. Hedge funds and other money managers have a net long position in WTI calendar spread options (physical and financial) equivalent to 144mn barrels that will make money if the spreads continue to narrow. The tightening spreads imply that traders see a higher probability the market will move into deficit from the start of the second quarter rather than the start of the third.

They could also indicate a lack of traders willing to take a short position in the spreads given the likely market rebalancing. But they would also be consistent with a squeeze, with one or more traders accumulating a large long position in nearby futures and threatening to take them to expiry.

The first rule for executing a successful squeeze is to squeeze with the underlying fundamentals of the market rather than against them. The regular tightness of the Brent market in the second and third quarters makes it vulnerable to squeezes at this time of year if traders accumulate long futures positions (outright or in the spreads) and then buy physical cargoes.

The Brent market is very small with only 40 to 50 cargoes loaded each month, which means the purchase of even a small number can tighten the market considerably. Brent availability is often restricted during the summer when field operators take advantage of better weather to undertake routine maintenance.

And Brent maintenance corresponds with the annual peak in oil demand during the US summer driving season and the summer airconditioning season in Saudi Arabia and Iraq. If Opec is successful in creating a supply deficit and drawing down oil stocks, Brent could become very tight this summer.

A successful squeeze, or even just the possibility of one, would make that tightness even worse. Fundamental tightness and the possibility of a squeeze are complementary rather than exclusive explanations for the tightness of the Brent spreads.

Opec’s expected success in draining inventories, hedge fund bullishness about the shift from contango, and the possibility of a squeeze are combining to push the Brent market towards a backwardation.

* John Kemp is a Reuters market analyst. The views expressed are his own.

.