The head of Saudi Arabia’s debt management office, who oversaw the kingdom’s $17.5bn sovereign bond sale in October, is leaving to rejoin HSBC Holding’s local unit, according to people with knowledge of the matter.

Fahad al-Saif, who was seconded to the Ministry of Finance in May, plans to return to Saudi British Bank as head of global banking and markets, the people said, asking not to be identified as the negotiations are private. Al-Saif will also rejoin the board of HSBC Saudi Arabia Ltd, the British lender’s local investment banking unit, they said.

The Saudi government hired al-Saif to establish the debt management office as part of preparations for its debut international bond sale, which was a record for emerging markets. He was among government officials who met with investors on the roadshow for the debt sale. The kingdom is “very likely” to tap debt markets later this quarter with an Islamic bond, Finance Minister Mohammed al-Jadaan told Bloomberg in December.

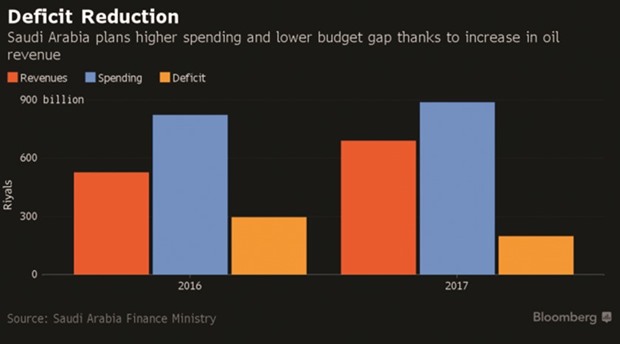

The kingdom is selling debt to help fill one of the biggest budget deficits in the Middle East after a slump in oil prices eroded revenues. Officials outlined a plan in December to keep narrowing the deficit before it possibly turns into a surplus by 2020. Government debt levels will have increased to 30% of economic output by then, from 7.7%, according to targets set out in an economic transformation plan released in June.

The Ministry of Finance didn’t respond to requests for comment, while a SABB spokesman declined to comment.

The world’s biggest oil exporter plans to raise between $10bn and $15bn from international bond markets in 2017, Mohammad al-Tuwaijri, secretary-general of the Finance Committee at the Royal Court, told Saudi-owned Al Arabiya television in December.

“The markets are anticipating a new transaction from Saudi early in 2017 and they are likely to be able to successfully retap the markets considering that issuance out of the region has not yet started to reach very high volumes,” Apostolos Bantis, a credit analyst at Commerzbank AG in Dubai, said in e-mailed comments on Wednesday.

Authorities will also raise about 70bn riyals ($18.7bn) from local bond sales, al-Tuwaijri told Al Arabiya. Last year, the government raised 97bn riyals from the sale of domestic bonds, according to the 2017 budget.